Some Ideas on Real Estate Reno Nv You Need To Know

Table of ContentsExcitement About Real Estate Reno NvSome Known Details About Real Estate Reno Nv Real Estate Reno Nv Things To Know Before You BuyThe Facts About Real Estate Reno Nv Revealed

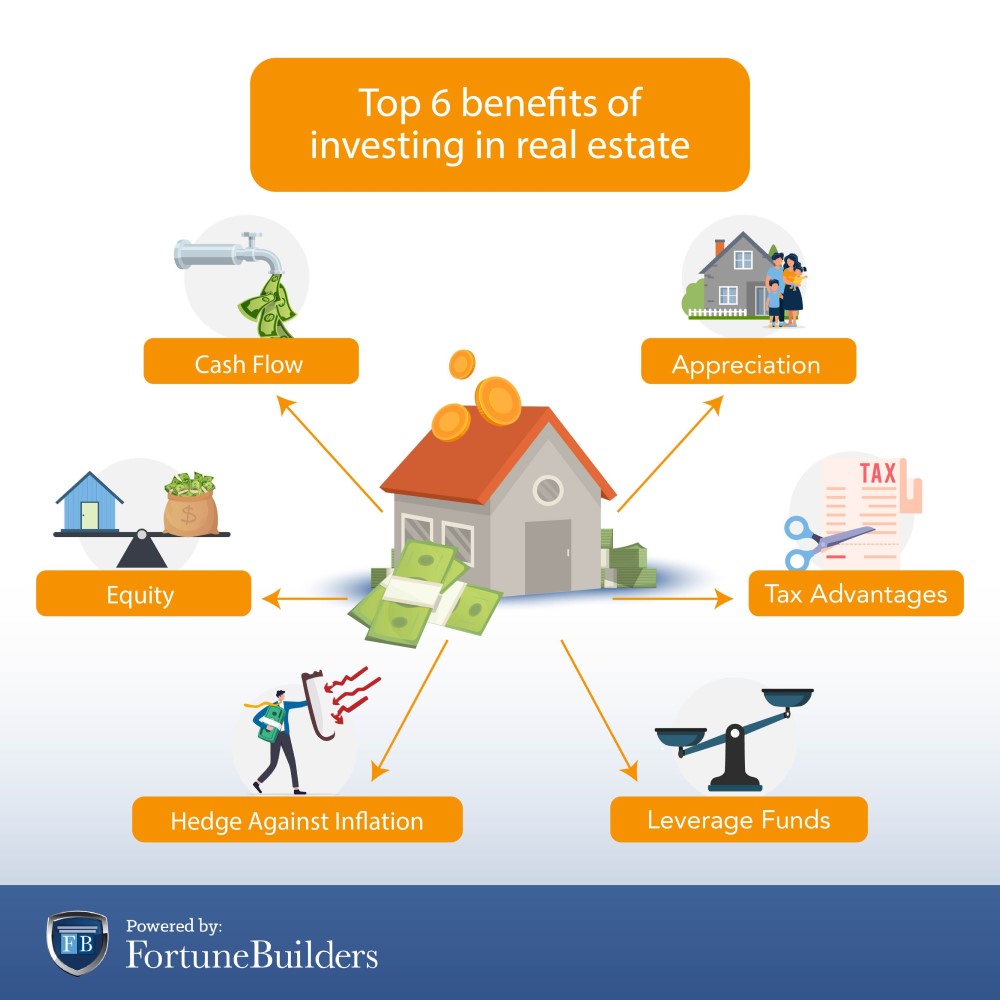

That might appear costly in a globe where ETFs and common funds may bill as low as absolutely no percent for building a varied portfolio of supplies or bonds. While systems might vet their investments, you'll have to do the very same, and that means you'll need the abilities to assess the chance.Caret Down Capital admiration, returns or interest payments. Like all investments, property has its advantages and disadvantages. Right here are some of the most essential to maintain in mind as you weigh whether or not to purchase property. Long-lasting appreciation while you stay in the building Potential bush against inflation Leveraged returns on your financial investment Easy income from leas or with REITs Tax advantages, including passion deductions, tax-free funding gains and depreciation write-offs Repaired lasting funding available Admiration is not assured, especially in financially depressed areas Residential property prices might drop with higher rate of interest rates A leveraged investment implies your down payment is at danger May require significant time and money to handle your very own residential properties Owe a set home loan repayment each month, also if your occupant doesn't pay you Lower liquidity for real residential property, and high payments While actual estate does offer several advantages, specifically tax obligation advantages, it does not come without considerable downsides, specifically, high compensations to exit the market.

Or would certainly you choose to analyze offers or financial investments such as REITs or those on an online platform? Knowledge and abilities While many financiers can discover on the task, do you have special skills that make you better-suited to one kind of investment than one more? The tax obligation benefits on real estate differ extensively, depending on exactly how you spend, yet spending in real estate can provide some substantial tax advantages.

:max_bytes(150000):strip_icc()/most-important-factors-investing-real-estate.asp-ADD-FINALjpg-32950329a30d4500b6d7e0fd0ba95189.jpg)

The Real Estate Reno Nv Statements

REITs use an attractive tax account you won't sustain any kind of capital acquires taxes up until you market shares, and you can hold shares actually for years to stay clear of the tax obligation man. In fact, you can pass the shares on to your successors and they will not owe any taxes on your gains.

Realty can be an appealing financial investment, yet investors intend to make sure to match their kind of financial investment with their determination and capacity to handle it, including time commitments. If you're wanting to generate earnings throughout retirement, property investing can be one method to do that.

There are numerous benefits to spending in genuine estate. Constant earnings flow, strong returns, tax benefits, diversification with well-chosen assets, and the ability to leverage wide range with property are all advantages that investors may enjoy. Below, we dig into the various benefits of buying realty in India.

All About Real Estate Reno Nv

Real estate has a tendency to appreciate in worth in time, so if you make a clever investment, you can profit when it comes time to offer. Gradually, rents additionally have a tendency to increase, which may increase capital. Rents boost when economic climates increase since there is more demand genuine estate, which increases weblink resources values.

Among the most attractive sources of easy revenue is rental income. Among the easiest techniques to preserve a stable income after retirement is to do this. If you are still working, you might maximise your rental revenue by investing it following your monetary goals. There are different tax obligation advantages to realty investing.

5 lakh on the principle of a home finance. In a comparable vein, section 24 permits a reduction in the necessary passion settlement of approximately Rs 2 lakhs. It will drastically minimize taxed earnings while reducing the price of property investing. Tax obligation reductions are offered a selection of prices, such as firm costs, cash money flow from other properties, and mortgage rate of interest.

Realty's link to the other major property groups is delicate, at times also unfavorable. Property may consequently lower volatility and increase return on risk when it is consisted of in a profile of different assets. Contrasted to my sources various other assets like the supply market, gold, cryptocurrencies, and financial institutions, buying actual estate can be dramatically much safer.

Real Estate Reno Nv Fundamentals Explained

The stock exchange is continuously transforming. The genuine estate sector has expanded over the previous a number of years as an outcome of the implementation of RERA, reduced home mortgage rate of interest, and other variables. Real Estate Reno NV. The rate of interest on financial institution interest-bearing accounts, on the various other hand, are reduced, especially when contrasted to the climbing inflation